What Makes Real Estate Less Volatile than the Stock Market

According to a Gallup poll, Americans have favoured real estate as their primary long-term investment for the last eight years. It is estimated that more money is invested in real estate in the US than equities in the stock market. As of 2018, the US stock market was valued at $30.4 trillion, while US real estate held an estimated value of $49.3 trillion.

In addition, data shows that over the past decade, real estate has surpassed stocks as the most favoured long-term investment in America. This is due to the obvious advantages that real estate holds over the stock market.

In this article, I will explain why stocks are more volatile when compared to real estate. Let’s get started…

What causes the volatility of stocks?

Volatility and correlation are two factors that contribute to a high degree of the changeability of stocks.

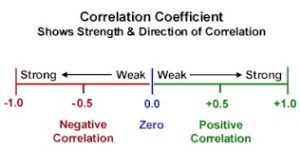

The correlation is defined as the effect of one investment on another while the volatility is the effect of swings in the value of a security in either direction, and the possibility of those swings occurring. You can educate yourself more by looking at the correlation coefficients of different investments. Investopedia and google search may be a good way to start.

A volatile investment can have changes in value spread over a wide range.

There is a noticeable increase in volatility of the US stock market mainly due to the following reasons:

- The stock market’s high efficiency allows large volumes of publicly traded investments to be sold quickly – five billion shares are traded daily. Despite its efficiency, the market’s high trade volume also contributes to its volatility.

- The US stock market owned 6.8% of index funds in 2010. This figure climbed to 13.6% in 2019. As a result of a few hands holding a large portion of the market, buying and selling decisions have become more aligned.

- A marked decline in the number of public investment options contributed to an increase in correlation in the stock market. By 2018, there were 4,397 publicly traded companies, down from 8,090 in 1996.

- Market volatility is increasing in tandem with correlation. From 1950 to 1999, there were 81 days during which daily changes in the S&P 500 exceeded 3%. However, there were 120 daily movements of 3% or more between 2008 and 2018. The annual average movement between 1950 and 1999 was 1.6. It was 6.3 between 2000 and 2018.

What makes real estate less volatile?

Real estate is more stable than the stock market for a variety of reasons.

- Real estate has high levels of inefficiency, creating the exact opposite of what is seen in stock markets with high levels of efficiency. Real estate transactions are not easily accessible or widely available. Buyers and sellers are few and transaction costs are high. As a result, trade volumes and volatility are lower.

- As real estate is traded less frequently than stocks, it is more illiquid than stocks. The real value of an investment is less likely to change daily; changes in real estate values are usually smaller and sporadic. Real estate is less susceptible to price swings, making it a better investment over the long term.

- Daily price movements in the stock market are unlikely to affect real estate values. They are highly uncorrelated.

- As inflation rises, the value of every investment decreases. Yet some assets, called hard assets, can outpace inflation. These assets have intrinsic value since their supply is limited. These factors allow such assets to maintain their value at a rate above inflation. One such asset is land and different commercial assets like apartments; as it becomes scarcer, its demand increases and its value expands.

- The scarcity of real estate allows owners to capture many of the benefits associated with it, including increased rental income and value appreciation.

- Investors can make above-market returns due to the unequal sharing of information about real estate transactions. Since fewer buyers and sellers have access to the same information, an investor may use his or her knowledge to buy below market value and sell above market value. Investors can’t do that in the stock market.

For these reasons, real estate is the preferred investment option for long-term investors. This makes real estate the best option for complementing stocks and diversifying portfolios.

In case you are considering investing in real estate, you do not have to do it alone. Through strategic, large multifamily investments, Blue Ocean Capital works with accredited investors to grow their wealth. To learn more, feel free to reach out to us today.

Schedule a call NOW

Add $1 Million to

Your Net Worth,

Passively

Basic of

Multifamily

Syndication

Sign Up!